how does hawaii tax capital gains

Hawaii has a graduated individual income tax with rates ranging from 140 percent. Ad Learn about Opportunity Zones.

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Urban catalyst is a leader in Opportunity Zone investing.

. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. How does Hawaiis tax code compare. Gain is determined largely by appreciation how much more valuable a property is.

Selling and moving to a Roth isnt necessarily a bad idea because from that point you will. Ad Learn about Opportunity Zones. Tax Law and Guidance Hawaii Taxpayers Bill of Rights PDF 2 pages 287 KB October 2019 Tax Brochures Tax Law and Rules Tax Information Releases TIRs.

The Hawaii Income Tax Hawaii collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Income tax rate schedules vary from 14 to 825 based on taxable income and filing status. A majority of US.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. What is the actual Hawaii capital gains tax. Hawaii taxes gain realized on the sale of real estate at 725.

Urban catalyst is a leader in Opportunity Zone investing. Find Hawaii Capital Gains Tax Rate Compare Results. 3225 Additional State Capital Gains Tax Information for Hawaii While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital.

Under current law a 44 tax rate is imposed on taxable income less. If you sell at a long term gain you will pay some amount of taxes on it. You will pay either 0 15 or 20 in tax on long-term capital gains.

The Hawaii capital gains tax on real estate is 725. The Hawaii capital gains tax on real estate is 725. Capital Gains Tax in Hawaii In Hawaii long-term capital gains are taxed at a.

Long term gains tax is never 0. Taxes in Hawaii Hawaii Tax Rates Collections and Burdens. Ad Search Smart with find-infoco.

If the collected amount is too large how do you obtain a refund. Some States Have Tax Preferences for Capital Gains. Individual Income Tax Chapter 235 On net incomes of individual taxpayers.

Potentially pay 0 in Capital Gains. States have an additional capital gains tax rate between 29 and 133. Compare Answers Top Search Results Trending Suggestions.

What is the actual Hawaii capital gains tax. Potentially pay 0 in Capital Gains. The information provided in this.

The difference between how much is withheld and. Conversely a capital loss occurs when you sell an asset for. The capital gains tax is imposed on the profits from sales of capital assets such as houses stocks bonds or jewelry.

Find Hawaii Capital Gains Tax Rate. The state derives its constitutional authority to tax from Article VII of the state constitution. This applies to all four factors of gain refer below for a discussion of the four factors.

That applies to both long- and short-term capital gains. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96.

Capital Gains Taxes Capital gains are currently taxed at a rate of 725 Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Generally only estates. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. Includes short and long-term Federal and.

The Hawaii capital gains tax on real estate is 725. Capital gains tax also known as CGT is a type of tax paid when you sell an asset for more than you bought it for. The rates listed below are for 2022 which are taxes.

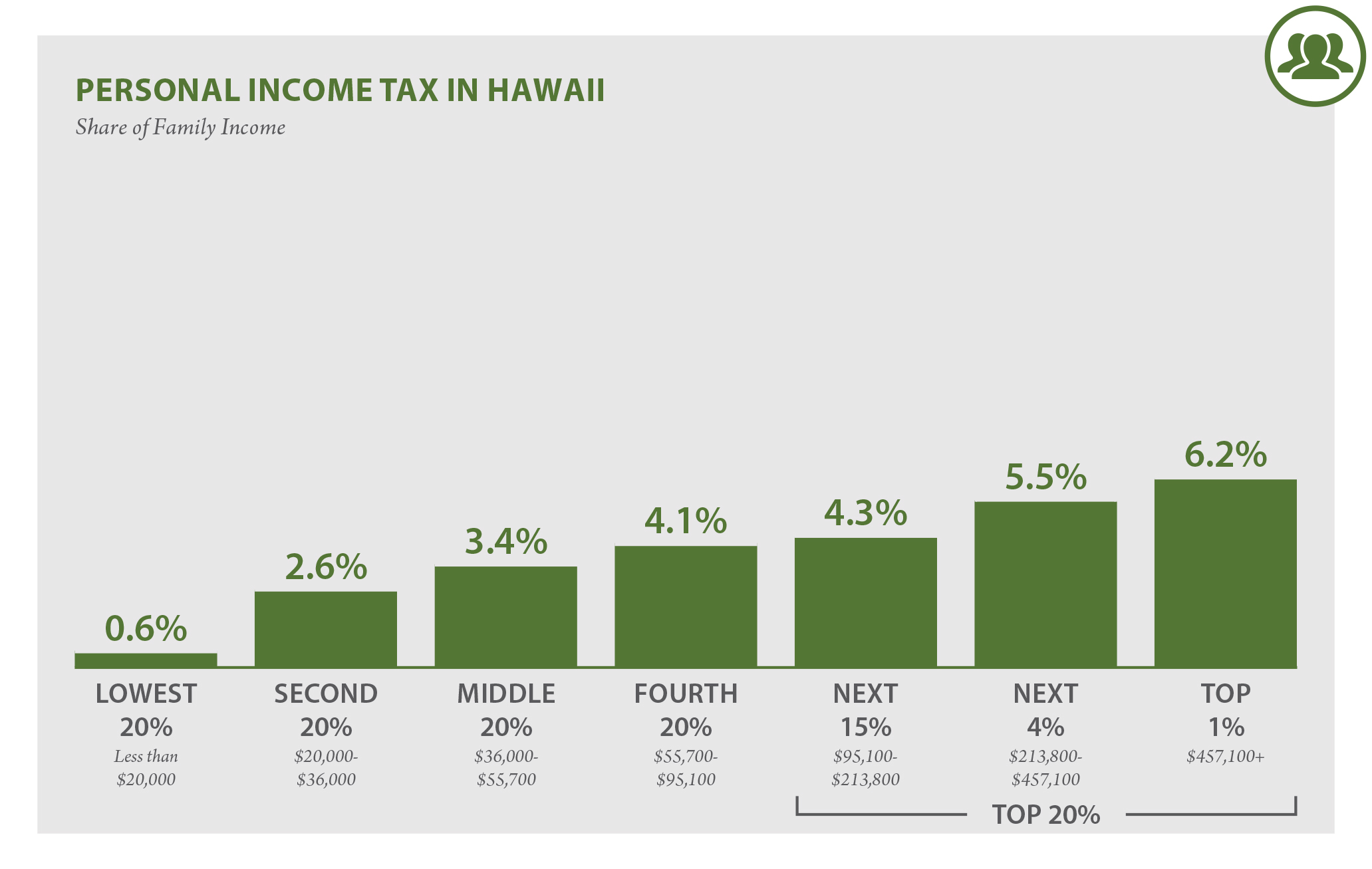

Hawaiis capital gains tax rate is 725. Like the Federal Income Tax Hawaiis income tax allows couples. Hawaii generates the bulk of its tax revenue by levying a personal income tax and a sales tax.

The federal government taxes income generated by wealth such as capital gains at lower rates than wages and. The current top capital gains tax rate is 725 which. States That Tax Capital Gains.

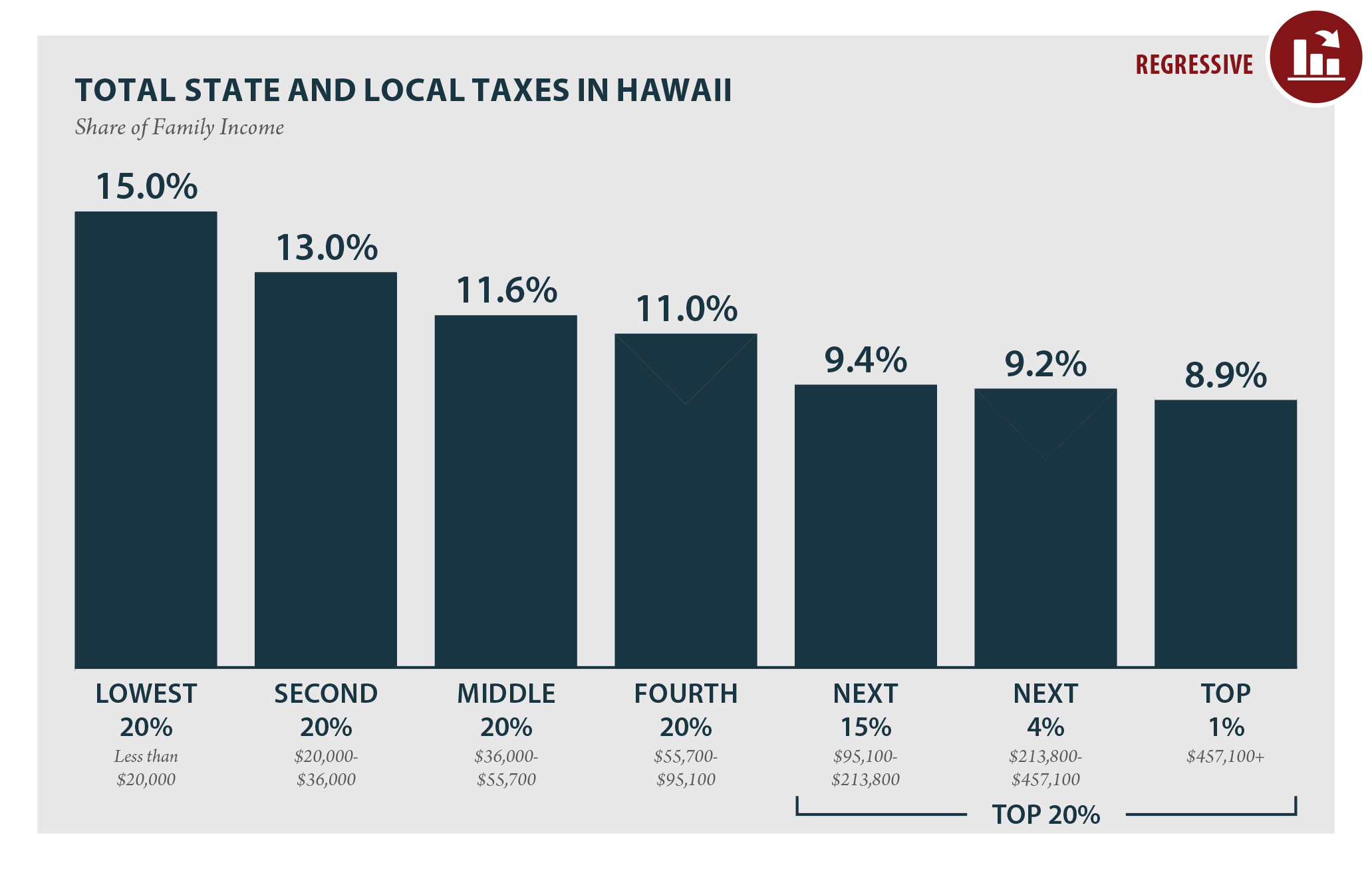

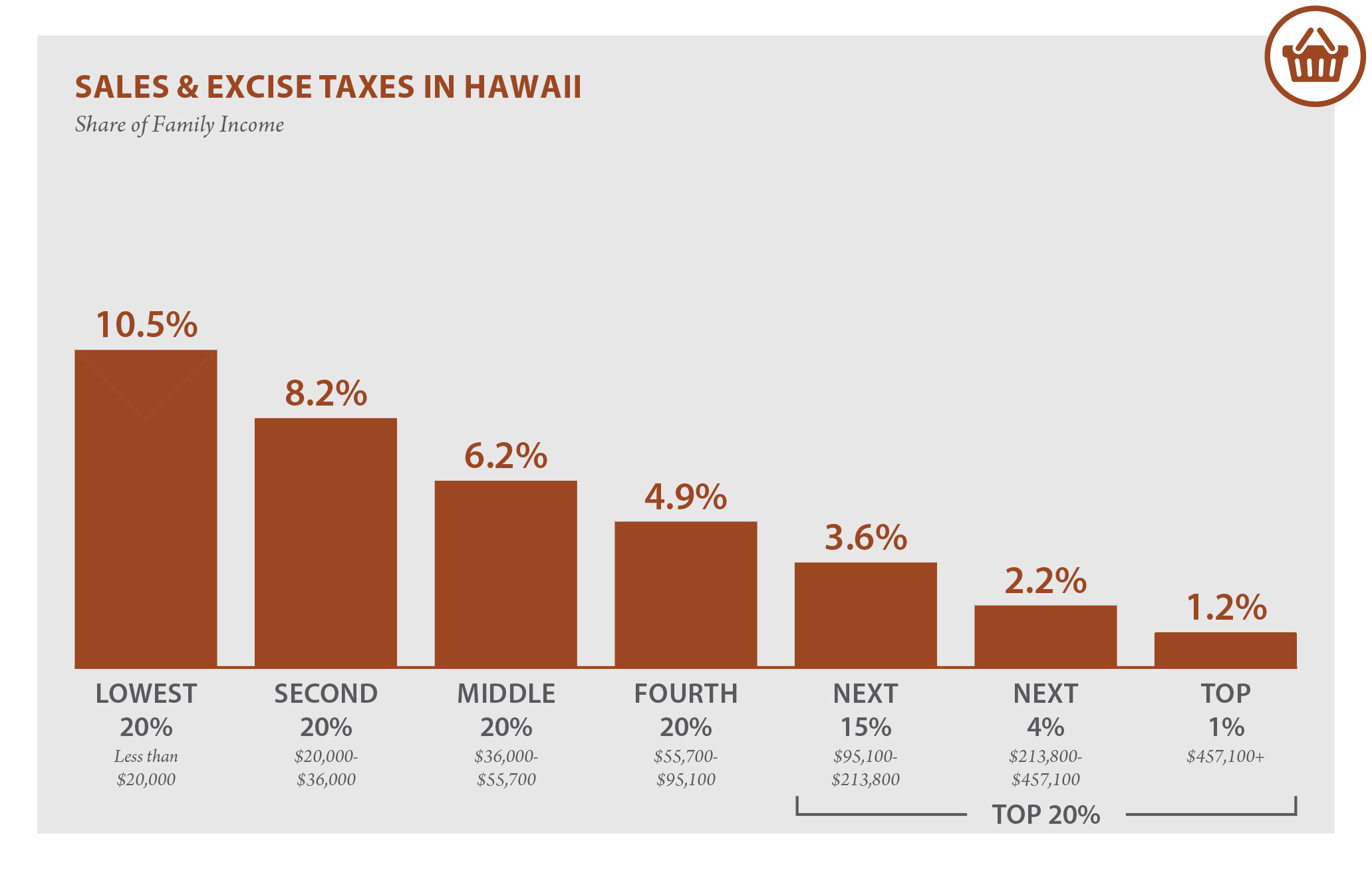

Hawaii Who Pays 6th Edition Itep

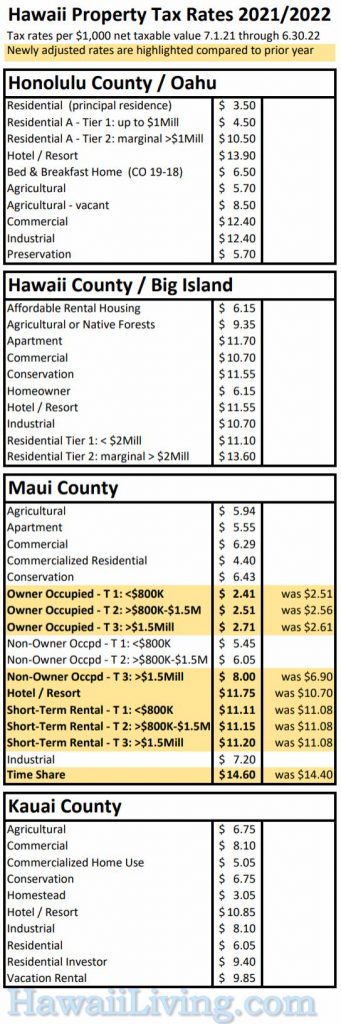

The Ultimate Guide To Hawaii Real Estate Taxes

Hawaii Income Tax Hi State Tax Calculator Community Tax

Hawaii Who Pays 6th Edition Itep

Hawaii Income Tax Hi State Tax Calculator Community Tax

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

The Hawaiian Shirt Through The Decades

New Hawaii Property Tax Rates 2021 2022

Hawaii Who Pays 6th Edition Itep

Hawaii Real Estate Transfer Taxes An In Depth Guide

Pin On Charts Graphs Comics Data

Are You A Hawaii Landlord Please Read This

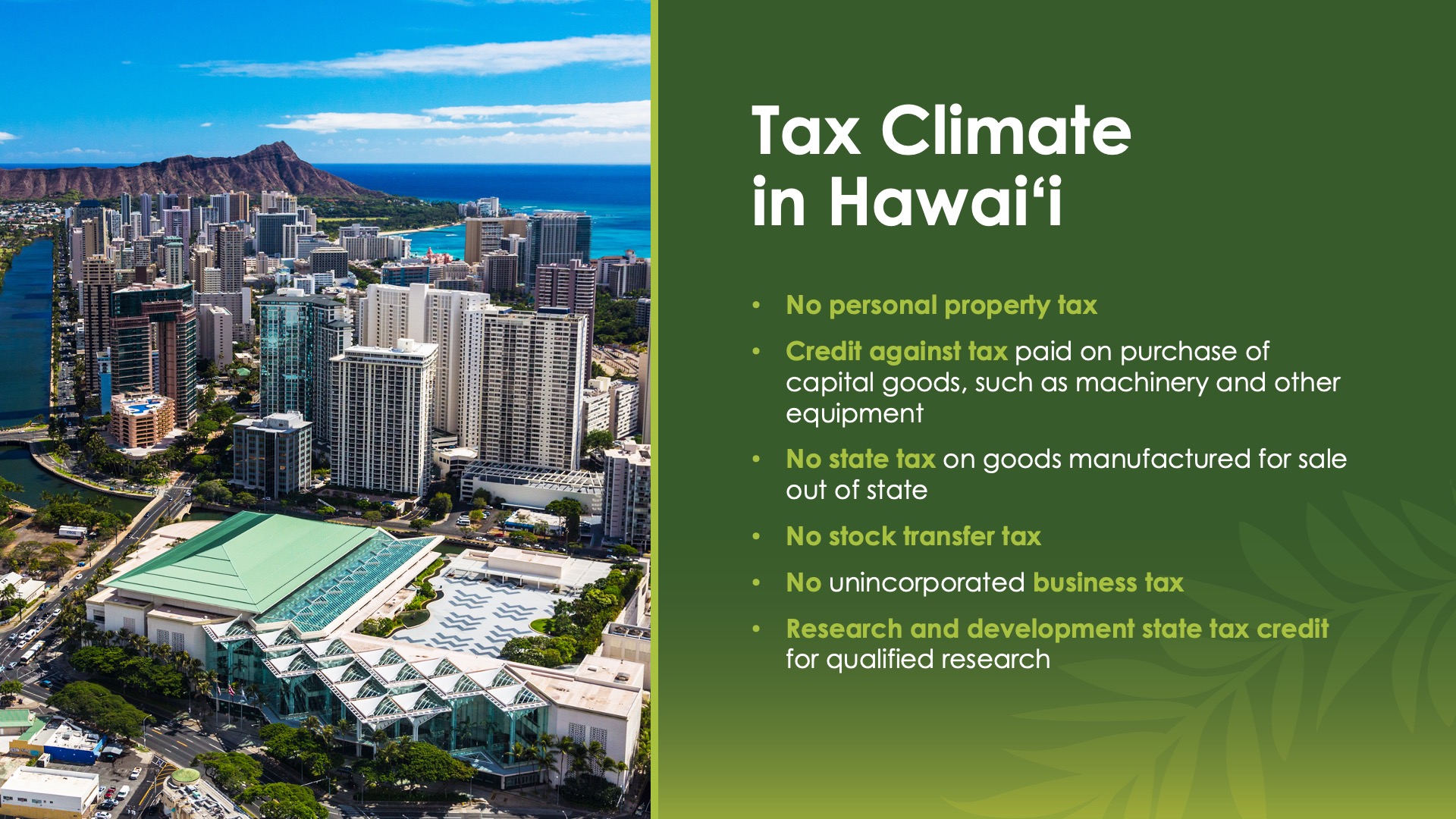

Business Development And Support Division Tax Incentives And Credits

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Monday Map State Local Property Tax Collections Per Capita Tax Foundation

Historical Hawaii Tax Policy Information Ballotpedia

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

Hawaii Income Tax Hi State Tax Calculator Community Tax

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition